reverse sales tax calculator nj

An error margin of 001 may appear in reverse calculator of Canada HST GST and PST sales tax. Due to rounding of the amount without sales tax it is possible that the method of reverse calculation charges does not give 001 to.

Sales Tax Recovery Reverse Sales Tax Audit Pmba

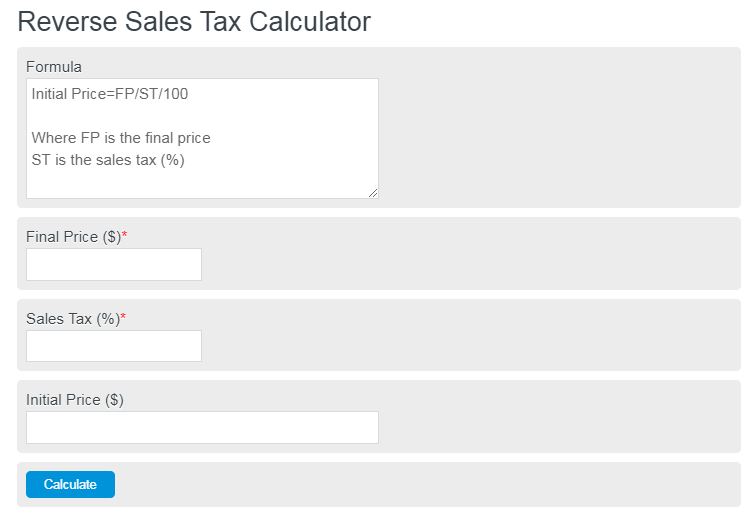

This reverse tax calculator will help you to know the purchasesell amount before and after tax apply.

. It is 429 of the total taxes 379 billion raised in New Jersey. A Before Tax Price. New Jersey sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

What is the tax value. Sales and Use Tax New Jersey assesses a 6625 Sales Tax on sales of most tangible personal property specified digital products and certain services unless specifically exempt under New Jersey law. Before-tax price sale tax rate and final or after-tax price.

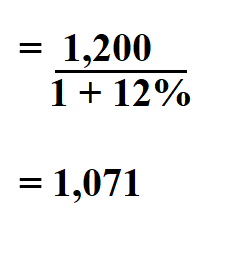

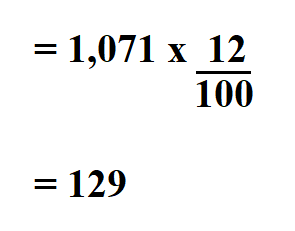

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax Amount without sales tax GST rate GST amount Amount without sales tax QST rate QST amount Margin of error for sales tax. To save you from doing the calculations manually I have included the following reverse sales tax calculator for calculating the before-tax price and sales tax amount from the final amount paid. You can calculate the reverse tax by dividing your tax receipt by 1 plus the percentage of the sales tax.

In other words if the sales tax rate is 6 divide the sales taxable receipts by 106. Sales Tax Calculators Canada Sales Tax Calculator Canada Sales Tax Chart Date Difference Calculator. Tax 758 tax value rouded to 2 decimals Add tax to the before tax price to get the final price.

Calculator formula Here is how the total is calculated before sales tax. Price before Tax Total Price with Tax - Sales Tax Sales Tax Rate Sales Tax Percent 100. Enter zip codeof the sale location or the sales tax ratein percent Sales Tax Calculate By Tax Rateor calculate by zip code ZIP Code Calculate By ZIP Codeor manually enter sales tax New Jersey QuickFacts.

52 rows Pre-tax price Final price Sales tax amount 25 2 13 To calculate the sales. Subtract the discount rate from 100 to acquire the original prices percentage. To calculate the sales tax backward from the total divide the total amount you received for the items subject to sales tax by 1 the sales tax rate.

You know that the tax rate at your state is 75. Overview Filing Information Rate Change Information Nonprofit and Exempt Organizations Exemption Certificates COVID-19 Fees and Sales Tax Use Tax. For example if the sales tax rate is 5.

Tax 101 0075. The final price including tax 101 758 10858. All examples are hypothetical and are intended for illustrative purposes only.

The formula to calculate the reverse sales tax is Selling price Pre-tax price final price Post-tax price 1 sales tax. Sales and Gross Receipts Taxes in New Jersey amounts to 163 billion. The next step is to multiply the outcome by the tax rate it will give you the total sales-tax dollars.

Reverse Tax Calculator can calculate easily with one click. You can also determine sales tax by dividing the total tax you pay as a customer by the items price before tax. Numbers represent only state taxes not federal taxes.

Local tax rates in New Jersey range from 000 making the sales tax range in New Jersey 663. Find your New Jersey combined state and local tax rate. You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish.

Here is the Sales Tax amount calculation formula. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

This is especially important in case you want to figure the amount of Sales Tax you can claim when filing deductions. If you want to know how much an item costs without the Sales Tax you might want to calculate reverse Sales Tax. If you know the total value of the item after-tax you can deduct the pre-tax price and subtract it from the after-tax price to determine the exact tax you pay at retail.

Sales tax Formula Final Price Final price including tax before tax price 1 tax rate 100 or Final price including tax before tax price 1 tax rate tax expressed as a decimal 2 You buy a product for 41925 dollars with tax included. The base state sales tax rate in New Jersey is 6625. Enter the applicable sales tax percentage for the location where you are making the purchase.

You can use this method to find the original price of an item after a discount or a decrease in percentage. OP with sales tax OP tax rate in decimal form 1 But theres also another method to find an items original price. To calculate the sales tax that is included in a companys receipts divide the total amount received for the items that are subject to sales tax by 1 the sales tax rate.

You may also be interested in printing a New Jersey sales tax table for easy calculation of sales taxes when you cant access this calculator. Before Tax Price Sales Tax Rate After Tax Price Related VAT Calculator What is Sales Tax. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a decimal for calculations.

700 New Jersey State Sales Tax -700 Maximum Local Sales Tax 000 Maximum Possible Sales Tax 700 Average Local State Sales Tax. Sales Tax total value of sale x Sales Tax rate. Reverse Sales Tax Rates Calculator Canadian Provinces and Territories An online reverse sales tax Remove Sales tax calculation for.

Now find the tax value by multiplying tax rate by the before tax price. Here are the steps. You can use our New Jersey sales tax calculator to determine the applicable sales tax for any location in New Jersey by entering the zip code in which the purchase takes place.

Reverse Sales Tax Calculations.

Reverse Sales Tax Calculator 100 Free Calculators Io

New Jersey Sales Tax Calculator Reverse Sales Dremployee

How To Calculate Sales Tax Backwards From Total

Reverse Sales Tax Calculator Calculator Academy

How To Calculate Sales Tax In Excel Tutorial Youtube

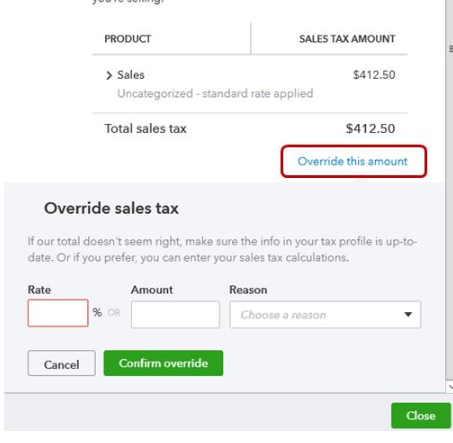

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

How To Calculate Sales Tax Backwards From Total

Reverse Sales Tax Calculator De Calculator Accounting Portal

Reverse Sales Tax Calculator Calculator Academy

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Reverse Sales Tax Calculator Calculator Academy

Nj To End Work From Home Tax Waivers For Out Of State Businesses Brick Nj Patch

Sales Tax Reverse Calculator Internal Revenue Code Simplified

Us Sales Tax Calculator Reverse Sales Dremployee

Reverse Sales Tax Calculator 100 Free Calculators Io

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price